The concept of insurance is not a modern invention. The Code of Hammurabi, one of the oldest legal texts, includes provisions for insurance. It dates back to 1750 BCE.

Learn more about the origin of insurance below.

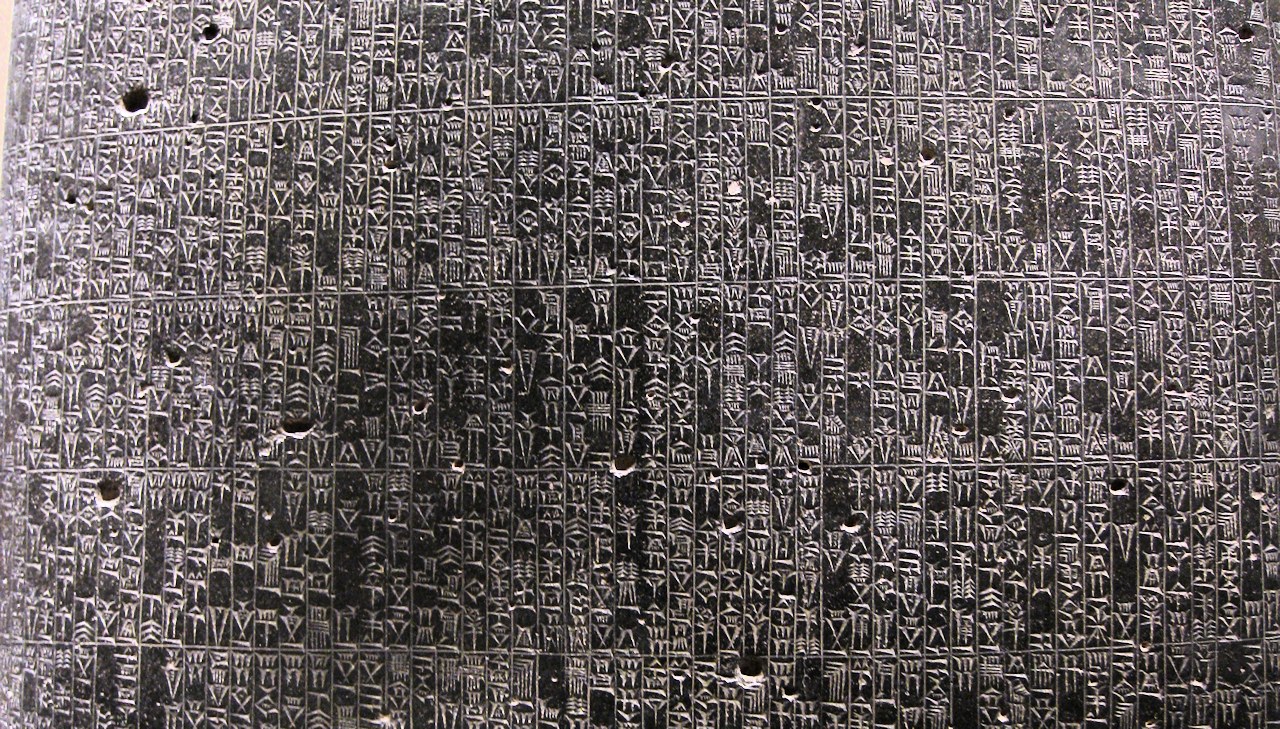

The First Written Evidence of Insurance

Insurance is a concept that has a long history, dating back to ancient civilizations.

One of the earliest references to insurance can be found in the Code of Hammurabi, one of the oldest legal texts known to humanity. This code was created around 1750 BCE in ancient Mesopotamia (present-day Iraq). It included provisions for various types of insurance.

The Code of Hammurabi was a comprehensive set of laws that covered a wide range of topics, including trade, commerce, and social issues. It was intended to provide a framework for society and establish rules and regulations to maintain order. Within this code, there were specific clauses related to insurance.

Maritime Insurance in the Code of Hammurabi

One of the provisions in the Code of Hammurabi dealt with the concept of maritime insurance. It stated that if a merchant took out a loan to fund a trading expedition and the goods were lost or damaged during the journey, the loan would be canceled. This was a form of insurance that protected the merchant from financial loss in case of unfortunate events.

Protection Against Loan Defaults in the Code of Hammurabi

Another provision in the code addressed the issue of loans and interest rates. It stated that if a borrower was unable to repay a loan due to unforeseen circumstances, such as a natural disaster or illness, the lender could not charge interest on the outstanding amount. This can be seen as a form of insurance that protected borrowers from financial hardship in difficult times.

Hammurabi’s Legacy

The above-mentioned provisions in the Code of Hammurabi demonstrate the ancient origins of insurance and the recognition of the need to mitigate risks and protect individuals from financial losses.

While the concept of insurance has evolved significantly over the centuries, the fundamental principles of providing protection and security remain the same.

The ancient roots of insurance remind us that humans have always sought ways to protect themselves against uncertainties and risks. The concept has endured throughout history, adapting and evolving to meet the changing needs of society. From the maritime insurance of ancient Mesopotamia to the comprehensive policies of the modern era, insurance continues to play a crucial role in our lives.

Brief History of Insurance

Insurance has come a long way since the time of Hammurabi. Today, it is a vast industry that spans various sectors, including life insurance, health insurance, property insurance, and more. Insurance companies offer policies that cover a wide range of risks, providing individuals and businesses with peace of mind and financial protection.

Here’s a short overview of insurance evolution from Hammurabi’s days to our times:

1750 BCE: Code of Hammurabi was created. It included some of the earliest references to maritime insurance and protection against loan defaults.

600 CE: Islamic merchants introduced the concept of “bottomry” contracts, providing loans for sea voyages with the ship itself as collateral.

14th century: Guilds in Europe established mutual aid systems to support members in times of illness, injury, or death.

17th century: The Great Fire of London in 1666 led to the establishment of the first fire insurance company, providing coverage for property damage caused by fires.

18th century: Insurance companies began offering policies for marine and cargo risks, as international trade expanded.

19th century: The Industrial Revolution prompted the growth of insurance for property, liability, and workers’ compensation, adapting to the changing risks of the time.

Late 19th century: The emergence of life insurance companies provided financial protection for individuals and their families in the event of death.

20th century: The introduction of automobile insurance addressed the risks associated with motor vehicles, and health insurance expanded to cover medical expenses.

Late 20th century: Insurance industry saw advancements in technology and data analysis, leading to more sophisticated risk assessment and underwriting practices.

21st century: Insurance industry embraces digital transformation, offering online policies, personalized coverage, and innovative products like cyber insurance.

Insurance continues to evolve, adapting to new risks such as climate change, cybersecurity threats, and emerging technologies like autonomous vehicles and artificial intelligence.

Conclusion

The Code of Hammurabi, one of the oldest legal texts, included provisions for insurance, showcasing the ancient origins of this concept. These early forms of insurance recognized the need to protect individuals from financial losses and provide security in times of uncertainty.

The evolution of insurance over time has transformed it into a vital industry that offers a wide range of policies to mitigate risks and safeguard against potential hazards.

The Code of Hammurabi stands as a testament to the enduring nature of insurance and its significance in human society.

FAQ

When was the concept of insurance first introduced?

The concept of insurance dates back to ancient times and can be traced to the Code of Hammurabi, created around 1750 BCE.

What is the Code of Hammurabi?

The Code of Hammurabi is one of the oldest legal texts known to humanity, a comprehensive set of laws that covered various aspects of society in ancient Mesopotamia.

What were the insurance provisions in the Code of Hammurabi?

The Code of Hammurabi included provisions for maritime insurance, protecting merchants from financial loss if goods were lost or damaged during trading expeditions. It also offered protection against loan defaults, preventing lenders from charging interest on outstanding amounts in cases of unforeseen circumstances.

Yo, Taiking88 on .net is where I’ve been chilling. Good vibes and decent odds! You should give it a shot. taiking88